Right on the heels of the Scottsdale auction where the six auction houses reported a combined 18% increase in sales, Mecum announced record setting sales for their ten-day Kissimmee event, the largest collector car auction in the world. And Mecum’s results were truly impressive; total sales for the 10-day event approached the $70-million mark, currently standing at $68,801,987, selling 1,771 cars of the 2,404 that crossed the auction block, for an exceptionally strong 74% sell-through. So based on the results of the January auctions, long considered to be a barometer of the collector car market for the coming year, collectors are feeling “warm and fuzzy.”

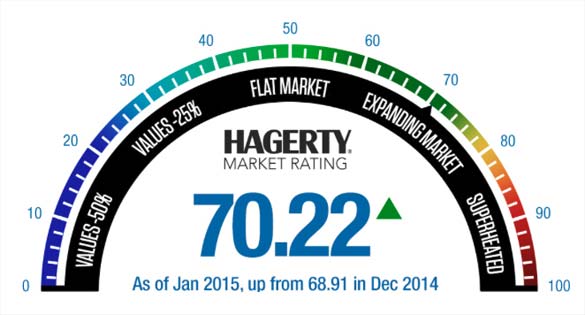

Hagerty, classic car insurance company and price guide publisher, launched a new marketplace rating tool which ranks the classic car market at 70.22, which means it is “expanding but not overheated.” Hagerty chief executive McKeel Hagerty, explained to ClassicCars.com, “We developed this as a tool to allow anyone who is serious about treating collector cars as investments to immediately take the temperature of the classic car market and truly understand the factors that cause the classic car market to move up or down.” But if you are a Corvette collector before you get too excited, based on January results Corvette auction prices are slipping.

This month’s number is the highest on record for the Hagerty Market Rating and the first time it has exceeded 70. Photo Credit: Hagerty.com

Though the overall collector car market looks healthy, it is not true for all segments of the market. McKeel Hagerty said. “Yes, some segments are overheated and some have recently cooled. However, on the whole, the current market rating is a healthy, expanding market through January.” Evident by the results of the January and late 2014 auctions, one of those segments that have “cooled” is the Corvette collector car market, specifically the second generation Corvette market. Prices for collector Corvettes have on the whole leveled off and for big block C2’s the market is one of the markets that have not only “cooled” but has dropped from the high prices being paid in late 2013 and early 2014.

One market analyst who declined to be named said, “From our analysis the slow down in the mid year Corvette market occurred in the spring following Mecum’s strong Houston sale. We are staying close to the numbers due to the impact the mid year Corvettes have on the overall Corvette market.”

And Corvetted’s analysis of the January auctions, particularly Barrett-Jackson and Mecum, confirmed that finding. After analyzing the Scottsdale auctions where most of Barrett-Jackson’s Corvette offerings were overshadowed by Ron Pratte’s collection of hot rods and muscle cars, Mecum’s Corvette results became an even more important barometer in evaluating the collector Corvette market segment. Due to Mecum Kissimmee’s diverse and numerous offerings it serves as a microcosm of the Corvette collector world. At Barrett-Jackson, aside from a just a handful of Corvettes it was difficult to get a firm read on the market although the softening of the mid year market were evident by the weak bids on some excellent midyears. In addition it was apparent that the previously red hot vintage Corvette racecar market has definitely cooled off with none of the three most important and documented Corvette racecars at the sale did not sell. In the hopes of capitalizing on the “Rebel’s” $2.85M sale in 2014 the two third generation L88’s were bid to a relatively weak $1.5M. Of course there are tiny segments of the Corvette market that are still holding their values, like the strong 1971 LS6’s. That finding was also confirmed by Mecum’s Kissimmee results.

Despite the softening market this 1971 LS6 convertible sold for over $200K. Photo Credit: Barrett-Jackson.com

But we also found evidence that the Corvette market overall no longer had the momentum that was evidenced in the rapidly appreciating market of 2012, 2013 and early 2014 (See chart below). The first Kissimmee indicator that the Corvette market had changed showed up before the first car crossed the block. The number of Corvettes consigned had slipped from 2014 consignments and there simply were not the number of high quality mid year Corvettes that were consigned in the past few years. The number of Corvettes offered over the ten days slipped from by almost 100 cars from 2014’s 398 to 281 in 2015.

On the upside, Mecum’s sell-through jumped from a bleak 58% in 2014 to 63% this year and although it was still more than 10% below the overall auction sell-through, nevertheless it is very respectable compared to other Corvette sell-throughs.. This year 176 of the 281 Corvettes offered found new homes, in 2014 that number was 232.

The quantity of high quality Corvettes consigned to Kissimmee for 2015 slipped from 2014 levels. One of the stars was this 1964 Corvette Tanker Lot R351 which sold for over $415K and was one of very few Corvette that sold within the estimate range. Photo Credit: Mecum.com

The improved sell-through is a welcome improvement and is most likely not attributed to increased demand, but rather other factors. The first factor was the consignors were more open to dropping their reserves and more realistic in their expectations evidenced by the increased number of Corvettes sold below estimated value. The second factor was the quantity of high dollar value Corvettes consigned (where sellers are not as likely to lower reserves) was less than in 2014.

This year in order to get a better read on the Corvette market we analyzed the results not only by generation but separated out entry level sales and results from the more desirable higher priced collector quality cars. In addition to the entire Corvette auction results, we examined sales of the best Corvettes consigned, the 90 first through third generation Corvettes scheduled to cross the block on Friday and Saturday. Then, where applicable, we examined how specific Corvettes did compared to their pre sale estimate.

The first thing that came as a surprise from the research was the sell through on C1, C2, and C3 Corvettes for Friday/Saturday was as strong or stronger than their generational sell though for all day combined, a fact contrary to past Kissimmee Friday-Saturday Corvette sell throughs. During the two-day period 90 first, second and third generation Corvettes crossed the block and 57 sold, a 63% sell through for the two days. Historically due to the higher quality and consignor expectations on peak days the sell though usually drops below the accumulated sell through for the entire event. This year this was not the case for collector Corvettes and was likely the result of more realistic expectations on the part of the seller.

First Generation

The encouraging news for enthusiasts who own or are considering a first generation Corvette is that the market is stable, no decline or major appreciation in value was evident. The best description is the first generation market is flat and no major shift has occurred recently like was seen in the second-generation big block models. One reason is that, unlike the second-generation models, first generation values have been relatively stabile for the last few years experiencing only a moderate increases in prices and has not experienced the dramatic jump in prices like the performance optioned second generation Corvettes.

Increased prices for first generation cars over the last couple years has been proportionate to the car’s performance options. Higher horsepower and big brake optioned first generation cars valuation is significantly higher than other optioned C1’s. Graphing the C1 price jump over the past few years is not as vertical as we see with second-generation cars; later first generation models with higher horsepower and rare performance optioned cars have increased 8% to10% percent over the last few years, significantly less than the 40% or more experienced by some big block second generation Corvettes. As a result, the first generation Corvettes have not experienced the slip in prices that C2 Corvettes have experienced in January.

Of the 23 first generation Corvettes that crossed the block on Friday and Saturday 14 sold with half of them selling for over $100K (two were resotmods). Only four first generation Corvettes had pre sale estimates set and one, Lot S188, sold above the high estimate (something not seen with C2’s). It was the top seller for first generation Corvettes and the only Corvette in the sale that sold above estimate. The recently restored silver blue 1958 and hammered for $155K on a pre sale estimate of $125K to $150K.

This exceptional 1958 Corvette was the only Corvette in the auction which sold above estimate. Lot S188 hammered for $155K. Photo Credit: Mecum.com

Lot S140, beautiful Duntov award winning 1957 Corvette, was sold for $115K, $10K below its low estimate of $125K. A rare 1955 Corvette roadster, Serial #002, Lot 194, was Bloomington Gold certified, and bid to $225K, right at midpoint of its $200K to $250K pre sale estimate, but failed to meet reserve. And another consignor took home his rare harvest gold 1955 with a green convertible top, Lot S200, after it was bid to a realistic $130K, well below it s high $150K to $200K pre sale estimate.

Like we saw in Scottsdale and understandable, the first generation Corvettes were the most prone to being modified and the restomodded first generation cars were bringing strong money. No longer is it considered heresy to modify an early generation Corvette, particularly if you want to drive and use the car.

The results for first generation Corvettes indicated the market demand and prices for top quality condition 1 and 2 first generation cars is steady while the lesser condition cars are experiencing some decrease in demand prices from 2012 and early 2013 levels. Though demand for top quality first generation Corvettes is currently stabile don’t expect to see much appreciation in value.

Second Generation

The sales results for second generation Corvettes, particularly the high horsepower later models experienced what can best be described as a market correction, especially for those models which jumped so dramatically in price over the last couple years (the high horsepower big block cars). Prices have clearly softened for these cars and was evident not only at Mecum’s but also at Barrett-Jackson.

Before we examine the Mecum second level sales results two examples from Barrett-Jackson should be examined as examples of the market shift. They are both very solid, authentic, big block 427/435 1967 coupes, lots 1307 and 1321. In spite of one of the most respected Corvette authorities in the country validating these cars calling them “bulletproof,” they still sold for considerably below the Hagerty low price valuation based on estimated values for December 2014. The first Lot 1307, a solid condition #2 coupe, should have brought a minimum of $140K to $165K and it sold for $115.5K (including buyer fees). The second, Lot 1321, with several Regional Top Flights, that should have brought no less than $125K sold for $106.7K (including buyer fees).

1967 427/435hp, Lot 1321, with several Regional Top Flights, that should have brought no less than $125K sold for $106.7K (including buyer fees). Photo Credit: Barrett-Jackson.com

In Kissimmee similar results were the norm with only a few mid year Corvettes selling within estimate range. Though prices were clearly not bringing the prices anticipated, the highly desired C2’s had a relatively strong sell though for Friday and Saturday of 64%, selling 34 of the 53 cars, attributed to, as previously explained, the consignors being more realistic in their expectations with fewer high dollar blue chip second-generation Corvettes as in the past. As example there were no L88’s, L89’s, only one Z06, and fewer of the coveted 1967 427 big blocks offered, possibly because owners knew the market was softening for those models. In 2014 there were 3 second generation Z06’s consigned (only one of the three sold) while there was only one this year and it did not sell. Last year there were 25 1967 427 Corvettes (including a rare 1967 L89) consigned versus this year’s 16. Only 8 of the 2014 67 427’s sold while 7 of 2015’s 16 hammered sold. (Editor Note: To be fair in the past we have been critical of Mecum’s low Corvette sell through percentages so we are pleased to see that they have weeded out some of the speculators that were just testing the market.) The results indicate the second generation Corvette market has lost the unsustainable momentum it has been used to since 2012 and prices are pulling back. That can be seen in the prices bid for strong blue chip second-generation cars. A total of 53 C2 Corvettes crossed the block on Friday and Saturday and 64%, 34 were sold. With the exception of a highly desirable and rare 1964 big tank coupe (Lot S164) that hammered for $415K (estimate $400 to $475) most of the other blue chip C2’s were flat or weak, selling below the pre sale estimate. In fact of those 16 second generation cars that had pre sale estimates set, only three managed to sell at or above the minimum estimate, nine sold below the minimum and four failed to meet the reserve and went unsold. Those blue chip collectibles that sold hammered for an average of only 88% of their pre sale LOW estimate. Considering prices bid for other blue chip C2s, those where a pre sale estimate was not set, an overall weakness and softening of second generation Corvette market is apparent, with none selling within the Hagerty estimate range.

One of the best examples of the price weakness can be seen in one of the feature Corvettes, the 1963 styling car that once belonged to Mrs. Harley Earl. At last year’s Kissimmee auction the same car was offered and it failed to meet the consignor’s reserve though it was bid to $340K. This year it was brought back with a pre sale estimate of $375K to $500K. The car was bid to a disappointing $230K, almost a third less than it was bid to last year; amazingly the consignor accepted the bid and the car sold.

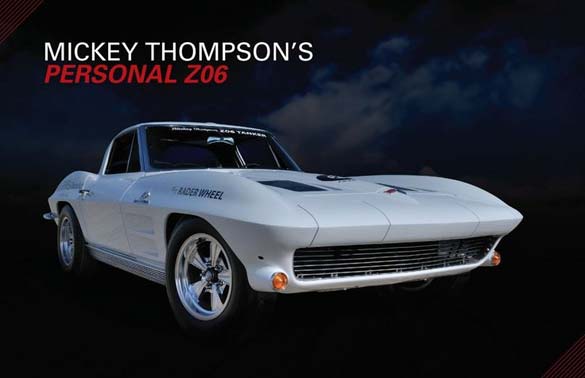

But there were other signs as well, like the only second generation Z06 in the 2015 auction, Mickey Thompson’s personal Z06. The highly promoted and documented authentic 1963 coupe had a pre sale estimate of $725K to $850K and could only garner a bid of $575K and went unsold.

Mickey Thompson’s Personal Z06 had a pre sale estimate of $725K to $850K and could only garner a bid of $575K and went unsold. Photo Credit: Mecum.com

Restored 427 cubic inch 1967 Corvettes, though always enticing are commonplace and the competition to own one is not as intense as it was a year or two ago. That comment in no way diminishes the desirability of those magnificent cars, it is only a statement on the current market conditions which have changed from the double digit appreciation in value we were seeing in 2013. What was considered a “seller’s market” two years ago is quickly becoming a “buyer’s market.”

It is important to also keep in mind that prior to last year most Corvettes were not at their all time market high levels. Most Corvettes enjoyed those high prices back in 2006. The market high prices were dramatically impacted by the economic downturn of 2008 where prices of condition 1 and 2 collector Corvette values fell by as much as 40%. For the next four years prices continued to fall even further. But as the economic conditions improved by 2012 several collectors and enthusiasts realized the relatively low prices and began buying the bargain collector Corvettes. That caused the Corvette market to boom through mid 2014 when Corvette prices began to approach 2006 and 2007 levels. In mid 2012 and through the next two years the most desirable #1 and #2 condition early Corvettes with rare options escalated in price by forty to fifty percent. Graphing the value growth showed an almost verticle line from 2013 to 2014. Clearly that growth was unsustainable and is similar to the recent growth in value of rare European cars. So what we are experiencing currently the the Corvette segment is a leveling or market correction to help bring the unsustainable and often unrealistic pricing in line.

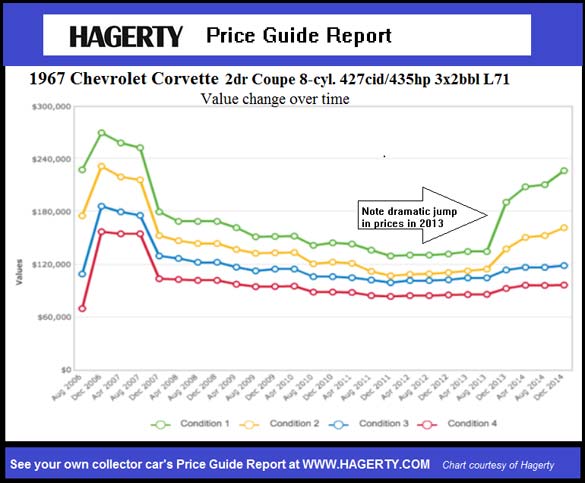

Check out Hagerty’s graph of a 1967 427/435hp coupe on the left. Note the dramatic jump in prices over the last year where prices jumped by an unsustainable 40%. You can check out graphs for any Corvette model at Hagerty to see those oprtioned Corvettes that experienced prices changes over market averages.

To see he change in Corvette values over the past nine years Hagerty offers several examples using their first-rate valuation tools, which can be tailored to a specific Corvette model. As an example we looked at the price changes of a 1967 Corvette Coupe with a 427/435 HP 3x2bbl L71 engine. Note the almost vertical jump in prices which occurred during the middle of 2013 where the price of condition 1, 1967 Corvette L71 coupes jumped from an average of $135K to $211K by August of 2014, an unsustainable 56% increase in prices. Even condition 2 examples jumped from $115K to $153K. Similar jump in prices can be seen on most other second-generation big block Corvettes.

Third Generation

There was not a sufficient number of blue chip third generation Corvettes offered to justify a specific conclusion about the C3 collector market. For the entire auction 80 third gens were consigned, most entry level Corvettes, and 42 sold. The 52% sell through was the weakest of all generations and surprising based on the fact that most of the unsold cars were unremarkable cars. If a conclusion can be drawn from that statistic it is mediocre Corvettes aren’t selling, especially third generation mediocre Corvettes. In support of that conclusion though only 14 third generation cars were offered on Friday and Saturday, 9 sold.

Worthy of note is the relative strength of the 1971 LS 6 Corvettes. At Barrett-Jackson a beautiful, authentic LS6 convertible sold for $203K and at Mecum a coupe (Lot 206.1) sold for $162K. Both cars sold within the estimate. Conversely, three 1969 L68 (427/400 HP) cars were offered and two sold below estimate around $50K while the third with factory air was bid to $65K but did not meet reserve.

“This beautiful 1971 LS6 sold for over $160K at the presale low estimate. Photo Credit: Mecum.com

One of the critical requirements for a third generation Corvette to hold or increase in value is the absolute necessity of a documented history and verified authenticity and originality. Clearly those cars without it either sold well below estimate or didn’t sell at all. And often even a documented, original rare example did not sell within estimate. One example was an exceptional 1971 LT1 (Lot T263) that hammered for $62K. And over the last few months we have even seen outstanding C3 L88’s sell below estimate. At Barrett-Jackson a Nabers Brothers restored 1969 L88 sold for $495K, more than $50K below Hagerty’s minimum estimate. The best advice for third generation market predictions is to keep a close watch on the market until a trend can be established, but do not expect much outside of market stability

Summary

Clearly the Corvette market in total is experiencing a slowdown. At best the collector Corvette market may be considered stabile, but within it certain segments are experiencing a market correction and prices have slipped. The concern is that this is occurring to the second generation cars and more concerning the big block, second level cars. Though it may be understandable based on he unprecedented growth in value in the relatively short period of 2013 -2014 a market correction may be healthy to avoid a long term decline or collapse in prices.

But keep in mind that most blue chip collector cars do not sell at auction, they change hands privately, often in clandestine negotiations rarely publicized. And it is not the auction prices alone that determine the values and estimates on cars; private sale play a big part in collector car price estimates. And those private purchases are usually not influenced by emotion like often happens in a volatile auction.

The best advice for sellers at auction for blue chip Corvettes is to make sure you have all your documentation available and accessible to potential buyers. Provenance and history are important and incomplete documentation gives rise to questions. As a seller either you or your representative should be on site to answer questions about your car and it is helpful to have a certified appraisal by a recognized authority available. The more legitimate documentation the better including judging sheets from the NCRS and Bloomington Gold. And spend a little money to market your car using professional pictures in auction catalogs or brochures. If the car has been restored pictures of the restoration and pictures of part and chassis numbers is helpful. And if you are serious about selling the car do not “test the market” with a high price. When the car fails to sell if you want to consign it to another auction the “no sale” at the first auction diminsihes its value to bidders. A common error is to overestimate the desirability of your car, remember your car is more valuable to you, especially if you have a lifetime of memories invested in it. Keep in mind that with rare exception your Corvette is not unique.

As a buyer you have heard countless times to get the advice of a recognized expert. I cannot stress that enough when buying a legitimate blue chop collector Corvette. Aside from the piece of mind it will give you it may save you from making a potentially disastrous and costly mistake. But after the fact is too late, find out before you place the first bid. Right now we appear to be headed into a Corvette buyers’ market so the ball is in your court, take your time and check prices of cars that have sold in the last few weeks or months to avoid over paying. Prices can easily fluctuate 10% or more in a month and basing your bid on the most current information may save you a lot of money And remember price estimates are only that, estimates; as we saw at Kissimmee several blue chip cars sold below estimate so don’t think you have to bid in that range. As a buyer do your homework, get help and try to keep emotion out of your bid.

Finally in reality a car, even a Corvette, is worth only what someone is willing to pay regardless of what the experts or anyone else tells you. So as you have heard several times before, if you are buying your Corvette as an investment buy the very best example you can afford, in the long run it is the safest investment. But for most Corvette enthusiasts keep in mind that most Corvettes are not investment cars, they are cars to be driven and enjoyed. So the best advice on the market is to invest in a Corvette that you are going to love and enjoy without regard to investment value or the thought of selling it.

Rick Tavel writes about automobiles with an emphasis on Corvettes and the hobby in general. You can see his website at Corvetted.

Sources:

Corvetted.com

Mecum

Barrett-Jackson

Hagerty

Related:

1953 Corvette VIN 274 Heading to RM Auctions at Amelia Island

[VIDEO] Rick Hendrick Buys the 2015 VIN 001 Corvette Z06 Convertible for $800K at Barrett-Jackson

Corvettes on eBay: Shriner Patrol’s 1967 COPO Corvette

-

![[VIDEO] Dennis Collins Checks the Numbers on a 1970 Corvette LT-1 Before Taking It Home [VIDEO] Dennis Collins Checks the Numbers on a 1970 Corvette LT1 Before Taking It Home](https://www.corvetteblogger.com/images/content/uploads/2024/04/041724_1-218x150.jpg)

![[VIDEO] 1978 Corvette Barn Find with 1599 Miles Gets First Wash in 45 Years [VIDEO] 1978 Corvette Barn Find with 1599 Miles Gets First Wash in 45 Years](https://www.corvetteblogger.com/images/content/uploads/2024/04/041324_8-218x150.jpg)

Excellent article. Making sure that I make a very informed purchase. If I purchase at all.

Comments are closed.